Why do clients pick you vs. your competitors?

It's obvious, but having an accurate, articulate answer to this question becomes an invaluable asset for leaders and team members across practically every function of your business. It may sound naive, but I used to think that the answer to this question primarily helped the marketing team in their efforts to develop effective content and messaging. However, I've come to learn that the answer is equally impactful for stakeholders in other areas - it helps salespeople sell more confidently and effectively, it helps the product team hone product strategy and roadmap, and it helps the executive team focus and foster alignment.

For more ideas on how accurate competitive win-loss insights can benefit various functions, check out this prior blog post.

Understanding Key Drivers: A Failed Attempt

The answer to the question above can be elusive. Many organizations, whether they realize it or not, struggle to uncover the real reasons why they win and lose. They base their analysis on a variety of approaches (i.e. talking amongst employees, mining CRM data, perusing competitors' websites and then guessing, etc.). Which approach is right?

While working as a product marketing manager at a fast-paced, high-growth B2B technology company, my team hired a new Head of Product Marketing. This came as welcome news, after many of us had spent years reporting to an overwhelmed and overburdened CMO. I was excited about the change. We hired someone who had experience running product marketing at a larger, more mature company for over a decade. He could coach us, lead us, and focus our efforts.

One of his first priorities when he arrived on the job was to answer critical questions like those I've already mentioned: Who buys our products? What are the key drivers for why they buy? Why do they choose us instead of our competitors?

His initial strategy for answering them was simple - a 3-day offsite with key members of the marketing team.

The group consisted of product marketers, content writers, digital marketers, etc. and the sole purpose of the activity was to answer key questions like: Where should we focus (i.e. segments)? And, how can we market effectively to those segments? Many of us, especially those with less experience, were optimistic. We thought the offsite was a great strategy; but, we soon encountered predictable snags. As we discussed possible answers to the question "how can we market effectively to those segments?" there was little consensus within the group about why customers ultimately picked us instead of our competitors. There were plenty of hypotheses and opinions, accompanied by plenty of contradictions and disagreements.

His next strategy was to leverage the sales team.

They are the ones closing these deals. They are on the phones all day with customers and prospects. They must know why we win and lose. So, we hit the sales floor. The members of our group divided up and overwhelmed the sales team. After dozens of conversations with salespeople, we reconvened. Surprisingly, we had made little progress. There were just as many conflicting opinions and inconsistencies. Our experience tapping the sales team for answers confirmed research that shows how sales reps are wrong about why they win and lose about 60% of the time.

Lastly, (finally) we went straight to our customers.

We were fortunate to have hundreds of thousands of customers that we could tap for feedback. With such a large audience we decided to send a survey. Though the process took several weeks, we finally started getting some consistent answers. For the first time in the entire process, we could see clear themes and trends. We confirmed some of the original hypotheses, disproved an equal amount, and uncovered some completely new ones.

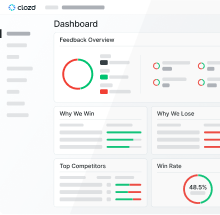

Note: Most B2B organizations don't have the luxury of fielding a survey to hundreds of thousands of customers like we did. Most B2B solution providers have far fewer clients or they sell to executive-level decision-makers that don't have time to take surveys. In such cases, a survey won't cut it; but, they still need direct feedback from those decision-makers to truly understand their win-loss drivers. For these reasons savvy B2B sales and marketing executives are implementing the practice of frequent, in-depth interviews with decision-makers at their won and lost accounts. The process is time-consuming and requires specialized expertise, but provides immense value. Due to issues with bandwidth, bias, and expertise most B2B companies outsource this process to companies like Clozd.

Lessons Learned

It was obvious to the group that engaging our customers shouldn't have been our final strategy. It should have been our first and only strategy. Being huddled in a room or relying on internal sources of feedback won't get you very far - and in many cases it will just set you back. You need to be talking to actual decision-makers if you want holistic, accurate, and unifying answers to these kinds of questions.

To uncover accurate win-loss drivers and competitive differentiators for your organization, follow these basic rules:

- Don't lock yourself in a room full of employees and expect to debate your way to the right answers.

- Don't rely on the sales team (or CRM data entered by the sales team) for answers. They're wrong about why they win and lose at least 60% of the time.

- If you're a B2C org (or a B2B org with millions of customers) then survey your buyers.

- If you're a B2B org, enlist a third-party to interview your buyers. Here's more reasons why.

Although my new boss may have started with some questionable strategies (1 and 2), we ultimately backed our way into the right one for our business (3). And, in the end, the insights we gleaned became catalysts for improved content, product strategy, and sales effectiveness.

Relevant Posts & Resources:

- Win-Loss Analysis: 5 Common Mistakes

- Win-Loss Analysis: Why use a third-party?

- The Definitive Guide to Win-Loss Analysis by Clozd

- The Four Pillars of Effective Win-Loss Analysis

.svg)

.png)

.svg)

.svg)