The only thing worse than losing an important deal is not knowing why.

Earlier in my career, I led the team that was responsible for closing what would be the biggest deal in the company’s history.

We thought we’d done everything right, and we were confident that we’d win the deal based on our technical capabilities and the relationship we’d formed with the prospect.

Then we got the news no sales leader ever wants to hear: They chose somebody else—and worse, we hadn’t even made it into the final round for consideration.

Our CEO was upset.

He called everyone involved into a room—proposal writers, the professional services team, and of course my sales team—and he went around the table asking each person to give their take on why we lost what would have been a landmark deal.

Each response was a carefully crafted “CYA” explanation that attempted to avoid taking any of the blame.

Finally, someone said, “Why don’t we just talk to the prospect and ask them what we did wrong?”

Brilliant idea, right?

So, we reached out to our contact, and they were happy to chat. When we asked why we lost, they told us that we were eliminated from consideration because our price point was too low.

“All the other vendors quoted a price 2–3 times higher than yours,” they said. “We didn’t even consider your RFP because we didn’t think you’d scoped the solution well enough, and we didn’t trust that you could deliver at that price point.”

I was shocked.

We lost because we were too … cheap?

winNobody sitting around that table with our CEO had guessed that we lost because we’d quoted them a price that was too low.

It was a big “Aha!” moment for me, and I realized that we had very little insight into what happens on the buyers’ side of the deal.

If you’ve ever worked in a revenue-generating role (sales, marketing, customer success) you probably have a story just like mine—where you’ve put a ton of effort, thoughtfulness, and resources into closing a deal, you feel like you’ve done everything right, and then that deal falls apart without a clear reason.

When this happens, everyone involved has guesses, assumptions, or gut impressions as to why deals are lost—but it’s impossible to know for sure unless you ask your buyers.

That’s why savvy sales organizations are relying more and more on comprehensive win-loss analysis programs to continuously capture and analyze the real reasons they win and lose sales opportunities—directly from the mouths of their buyers.

Game film for your business

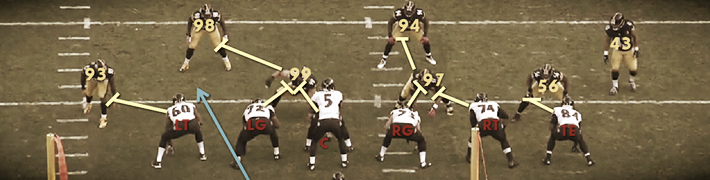

Win-loss analysis for your company is like film study for sports teams. Great teams use film study to review past games (their own and their competitors’) to uncover ways to improve their performance and increase the probability of success moving forward.

.png)

Like film study, win-loss analysis is the process of going back and reviewing your closed opportunities—wins and losses—to uncover the trends and insights that can influence future success rates. Effective win-loss analysis helps companies identify and prioritize critical product gaps, enhance sales training and performance, improve marketing effectiveness, and build strategic alignment.

As the business landscape evolves with new technology and industry competitors, you can rely on your win-loss analysis efforts to help you differentiate your unique value props and sharpen your competitive edge. At Clozd, our mission is to use our innovative services and technology to help your company win more.

Win-loss analysis defined

A comprehensive win-loss analysis program systematically gathers insights from buyer interviews, surveys, and CRM data, then identifies and assesses the factors that contribute to why you win or lose opportunities. The process entails an in-depth review of sales data and market research to understand buyer purchase behavior and perception. The end goal of a successful win-loss analysis program is to consistently gain actionable insights that can be used to enhance business performance at all levels.

Win-loss analysis will also help you know your competition better. The information you gather from your buyers’ experiences will help you gauge the effectiveness of your competitors’ sales strategies, capitalize on their successful systems, and identify strengths and weaknesses in your own organizational processes.

Using a buyer-first approach to identify your strengths, weaknesses, and immediate competition is critical. Clozd creates win-loss strategies with this in mind to help your business prioritize accordingly.

How to calculate your win rate & win-loss ratio

Unlike other revenue tools that help you automate outreach and generate more pipeline, the goal of win-loss analysis is to help you increase your win rate.

Many revenue leaders don’t know what their win rate is—and they don’t realize that increasing it by just a few percentage points can help them hit revenue goals more quickly (and with fewer resources and headcount) than simply driving more pipeline.

The simplest way to determine your win rate is to calculate the ratio of deals won to the number of total closed opportunities. (A closed opportunity is a deal where a buyer has made a final decision, and you’ve either won or lost.)

Once you analyze your win-loss ratio and calculate your win rate, you can get even more insight into why you’re winning and losing deals by adding context to your data.

For example, you can:

- Examine your win rate by team, studying what your top performers are doing right so you can turn those insights into a sales coaching program.

- Look at your win rate by industry to learn which prospects you’re most likely to close and where you should be focusing your marketing efforts.

- Get an overview of your win rate by geography to compare trends in different sales regions and territories.

- Filter your win rate by competitor, which will show you which companies you’re most likely to beat when you go head-to-head, as well as which companies tend to outperform you. This will allow you to create a sales and/or product strategy to step up your game and win more deals.

When filtered correctly and viewed with the right context in mind, your win rate can provide you with powerful and actionable insights that will help you know what changes to make so you can win more.

Check out our blog post for an in-depth look at how to calculate your win rate.

Win-loss analysis best practices

Well-executed win-loss analysis programs help determine how you rank among your competition and how your customers perceive your offers. The practices listed below help you get ahead and win more deals.

1. Identify your goals

Most win-loss analysis programs start in an effort to solve a specific problem. As you conduct your win-loss program, you'll quickly realize that every department can get value from the insights you gather. Here are several examples of common win-loss program goals:

- Analyzing the effectiveness of your pricing and packaging

- Improving customer satisfaction

- Identifying weaknesses in your sales process

- Uncovering the reasons your customers are churning

- Doing research for future product development

- Understanding why you’re losing to a specific competitor

Your goals may also be more specific to your business and particular circumstances.

2. Get Direct Feedback from Buyers

The richest insights will come from the decision-makers for won and lost accounts. Leveraging a neutral third party like Clozd to conduct the interview can help your buyers feel more comfortable sharing their experience with your product or service.

3. Identify key themes

Identify and track key themes in each win-loss interview. This includes the positive and negative factors that influenced your buyers’ final purchase decisions, as well as company-specific considerations (brand reputation, sales process, pricing, and more).

4. Continuously refine your business based on results

Ideally, win-loss programs should be an ongoing initiative. As your business evolves, there will be new issues to address. Refine your strategies based on the results, and calibrate the program as you gain more customer data. This can help tailor your offerings to changing market needs, retain existing customers, and stay ahead of the competition.

Do you know why you win and lose?

Can you imagine 80% of NFL teams skipping film study? That would be unthinkable. And yet, fewer than 20% of companies properly invest in win-loss analysis.

Most businesses are casual in their approach to win-loss analysis. They neglect the practice because their leaders claim to "already know why we win and lose." But in reality, they probably don’t. Many leaders base their conclusions on a tiny sample of customer interactions or anecdotes they hear from the sales team—a biased and unreliable source of information. Research has shown that sales reps are wrong about why they win and lose deals more than 60% of the time.

Companies that neglect win-loss analysis are missing out on a huge opportunity to increase sales win rates, sharpen their product strategy, and build a sustainable competitive advantage.

For a more in-depth introduction to win-loss analysis, including tips and best practices, download Clozd's comprehensive guide to win-loss analysis here.

The four pillars of effective win-loss analysis

The way football teams approach film study has evolved through the years. Better methods and technologies have given certain teams a distinct competitive advantage.

Likewise there are win-loss methods and tools that companies can employ to make win-loss analysis more effective. At Clozd, we bucket them into four categories that we refer to as the four "pillars" or "core competencies" of win-loss analysis:

1. Leadership & Culture

2. Data Collection & Quality

3. Data Synthesis & Analysis

4. Adoption & Action

Companies that invest in mastering these competencies can achieve powerful results. In fact, a study by Gartner found that companies that invest in rigorous win-loss analysis may achieve as much as a 50% improvement in sales win rates (Source: Gartner).

1. Leadership & Culture

Your win-loss program should start at the top. Senior level executives, including (especially) the CEO, endorse and oversee the program and establish a culture that values constructive criticism. They eagerly review win-loss insights and translate them into action. They view win-loss analysis as an ongoing pulse check on sales performance and the competitiveness of their product offering.

2. Data Collection & Quality

Great win-loss programs consist of actual conversations (interviews) with the decision-makers at won and lost accounts. Other data sources (such as CRM fields or sales reps) are less reliable, and other collection methods (like surveys) are too rigid, too leading, or lack sufficient depth and detail.

The best interviews are conducted by a neutral third party to promote candor and honesty on the part of the interviewee. The program and questions are designed to balance the needs of multiple functions—such as sales, marketing, and product development—so you can deliver insights relating to your product offering, sales team, competitive landscape, pricing and packaging, and more.

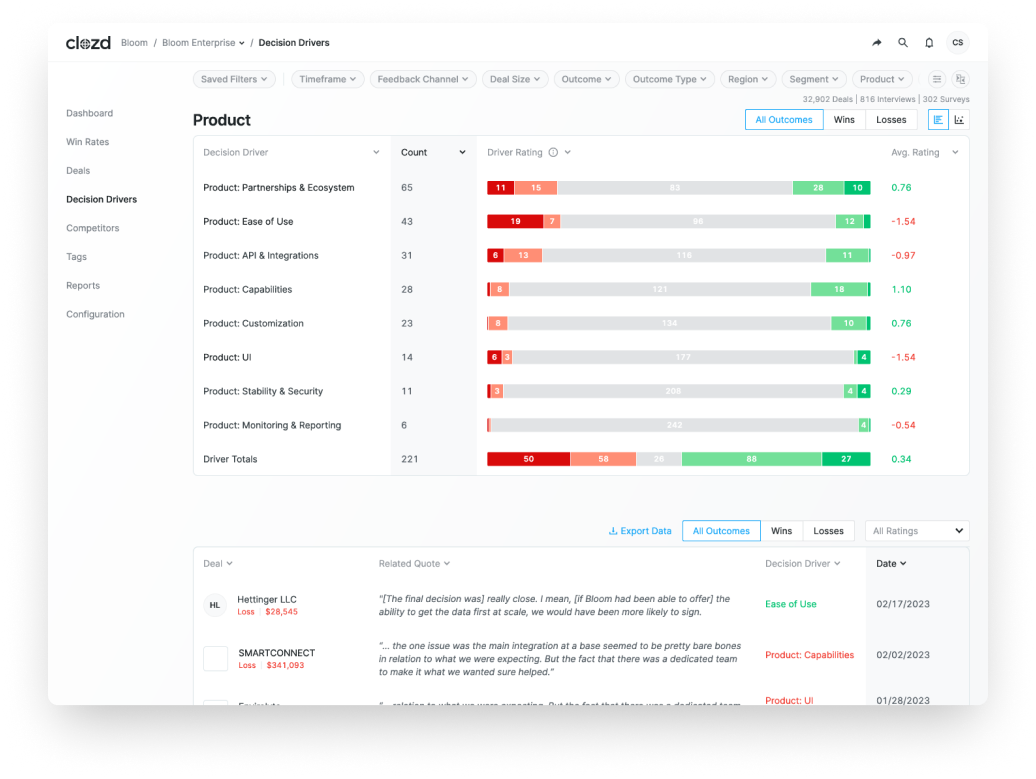

3. Data Synthesis & Analysis

It’s important to use a consistent and systematic approach to tagging key themes from each interview—and then track them over time to identify the trends that merit organizational action. Those themes and trends become the basis of internal win-loss dialogue and decision-making processes. Additionally, there are methods in place for tracking common quantitative metrics that measure and benchmark product performance, sales performance, and relative competitor performance over time.

.png)

4. Adoption & Action

Your win-loss program should leverage technology so you can share win-loss insights with stakeholders across your organization and encourage action. If it’s easy for key stakeholders to search, study, and adopt the findings, you’ll be able to foster an active, cross-functional dialogue about win-loss insights, and leaders can frequently reference them in meetings. The feedback shapes training, sales, and marketing content.

Win-loss analysis FAQs

How do I get my win-loss analysis program started?

Companies can initiate win-loss programs by analyzing their internal CRM data, conducting win-loss interviews on their own, or hiring a neutral third-party provider like Clozd. Opting for a third party is best as they provide unbiased feedback, typically receive higher response rates, are well-trained in asking the right questions, and have the technology in place to deliver the results at scale in a comprehensive format.

How do I conduct a win-loss interview?

Win-loss interviews are frequently conducted on a Zoom meeting or over the phone, either internally or by a reputable third-party service such as Clozd. These interviews entail identifying the best leads to talk with, asking the right questions based on your goals, and recording key themes with each conversation.

How do I perform win-loss analysis in Excel?

An Excel win-loss sparkline can help you spot trends and patterns across a large dataset and visualize your win-loss ratio. Follow the steps below to create a win/loss sparkline next to your data:

- Select your data.

- Click insert > Sparklines > Win-Loss.

- Select the data range you want to include in the analysis.

- Customize the colors and styles of your Sparkline for readability in the Style dropbox button in the Sparkline Tools tab.

Resources to help you get started

Learning about the importance of a win-loss analysis for organizational growth is the first piece of the puzzle. At Clozd, our mission is to help your company implement an ongoing win-loss analysis program to help you drive revenue and increase customer retention.

There's a wealth of resources that can help you design and implement an effective win-loss program at your own company. Here are just a few:

- Gartner Report: Three Ways Marketers Can Use Data From Win/Loss Analysis to Increase Win Rates and Revenue

- The Definitive Guide to Win-Loss Analysis

- Pragmatic Marketing: The Eight Rules of Successful Win-Loss Analysis

- Clozd's Win-Loss Analysis Learning Center (getting started, best practices, and the value of win-loss)

Visit clozd.com for everything you need to design and execute your own world-class win-loss program. We offer an experienced team, sound methodology, and innovative technology to help you start winning more.

.svg)

.png)

.svg)

.svg)