TL;DR

- B2B companies play a zero-sum game at the deal level.

- CRM data may not accurately reflect competitors; customer feedback is more reliable.

- Segmenting by deal data, not specific competitors, can reveal true competitors.

- Win-loss insights can validate suspicions and prevent costly mistakes.

- Focus on the customer more than competitors to stay ahead in the market.

At an individual deal level, most B2B companies are playing a zero-sum game.

If I win the deal, I get all the business. But if I lose, I get nothing—and I’ve likely spent a substantial amount of time, effort, and money in the process.

This is one of the main reasons we’ve continued to see a major emphasis on understanding the competitive landscape and how, as an organization, you stack up to your particular set of competitors. (As evidence of this, just look at the continued rise of dedicated competitive intelligence functions in recent years.)

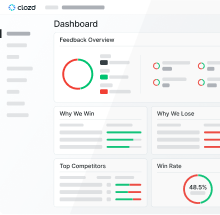

Because of that, it’s easy to understand why, when Clozd first engages with new clients, it’s common to hear that they want to home in on a specific competitor—or set of competitors—and center their research around why they’re winning and losing deals in those competitive situations.

The danger of this approach is that your strategy is completely reliant on the accuracy of your CRM data, and if it’s not crisp and clean, you’ll quickly be headed down the wrong path.

How does that happen?

Customer feedback is more reliable than CRM data

Let’s say you run a report from your CRM of closed-won and closed-lost opportunities, segmented by competitors. Consider how those competitors became associated with those specific opportunities in the first place—it was input by the sales rep working that deal.

The problem is that, in most cases, sales reps are making their best guess at which competitors the prospect is evaluating.

Win-loss data consistently shows that when you compare what’s logged in your CRM to what buyers actually say, different competitors are identified in nearly 7 out of every 10 deals. This means that, if you took a look at which competitor was tagged on any given opportunity in your CRM, you’re far better off assuming that competitor is NOT correct.

In short: It’s far more accurate to base your win-loss outreach on direct buyer feedback than on (often unreliable) CRM data.

Segment by deal data, not by specific competitors

An alternative option we suggest is taking a competitor-agnostic approach, which helps you organically see which companies your buyers most often view as your competitors.

So instead of segmenting by a specific competitor, consider segmenting your data based on deal size, geography, or product line, and then see which competitors your buyers naturally bring up. This approach will give you a much more accurate idea of what competitor set you’re actually seeing in those different segments.

These aren’t just hypothetical scenarios—Clozd has seen this play out time and again.

Using win-loss insights to validate your strategy

One early client first engaged with Clozd because they'd heard anecdotes about how one competitor was eating their lunch. It appeared to be a losing battle, and they slowly became hyper-focused (and worried) about that vendor. As a result, they dedicated significant time and effort to revamp their strategy, reallocating significant resources to put them on the right path and gain a competitive advantage.

Before hitting go and setting things in motion, however, the last step was to validate their suspicions.

As Clozd set out to interview buyers from these competitive opportunities, what did the interviews teach them? That they’d been worried about a boogeyman—the “competitor” they’d been so worried about was, in reality, rarely making a prospect's shortlist.

So how do you explain why that competitor was being tagged in the CRM so often? That competitor happened to be the first available option in the competitor dropdown list in the CRM, which means it was the path of least resistance for reps who had to tag some competitor on the opportunity. That, coupled with an anecdote here and there, painted a false picture and created unnecessary concern.

This nearly caused millions of dollars in resources to be spent erroneously, all because the decisions being made were based on flimsy CRM data. It wasn’t until they layered on buyer-centric win-loss data that they saved themselves from making a major mistake.

“Focus on the customer more than you focus on your competitors. It’s good to be aware of your competitors, their tactics, their strengths and weaknesses, their innovations, and how they may affect your business. … But you’ll stay ahead of your competition if you relentlessly focus on your buyer.”

—Spencer Dent, Co-founder & Co-CEO at Clozd

For a personalized Clozd demo, sign up here.

.svg)

.svg)

.svg)