At some point, every business leader realizes that they’ve got a big problem: They don’t know why they’re losing deals (and they’re not 100% clear why they’re winning them, either).

Typically, it starts when the executive team asks sales leaders the dreaded question: “Why did we miss quota?”

Most sales leaders will confidently give a response based on their intuition, or they’ll pass along some anecdotes from sales reps working key deals last quarter … but deep down, they’re nervous that they could be wrong.

Most sales leaders would give their right arm to be able to understand with certainty why they win and lose. Knowing exactly why you win and lose is like having a cheat code that solves your biggest business problems, such as:

- How to win more deals against your biggest competitors

- How to price and package your products

- Which features to add to your products so they feel tailor-made for your ideal customers

- How to reduce churn and keep your current customers happy

- How to dramatically cut down on ramp-up time for new salespeople

- How to refine your marketing messaging

The win-loss maturity curve represents the process business leaders go through as they work themselves closer to the Holy Grail of business insights—learning exactly why they win and lose directly from the mouths of their buyers.

Phase 1: Guesswork & assumptions

Most sales leaders have a general idea as to where the Holy Grail is hidden.

Some know that they’ve lost lots of deals because of pricing issues.

Others recognize that they aren’t doing a good enough job demonstrating the value of their product during the demo.

They may even know that customers are looking for specific features in their product that just don’t exist yet—but they feel like they don’t have the ability to influence the product roadmap.

Having a general idea why you’re losing can be helpful, but it’s only a first step.

It’s like Indiana Jones finding out the Holy Grail is somewhere in Turkey.

You might have a good idea where to begin your search, but you won’t find what you’re looking for unless you’re either incredibly lucky—or you get more detailed information.

Phase 2: Scouring internal data (CRM & sales)

Your CRM is often the quickest and most convenient place to start looking for data that can show you why you win and lose deals.

So you schedule a meeting with your Salesforce admin in the hopes of finding some long-ignored report or unused dataset that will unlock the coveted key to increasing your revenue. Initially, you might feel a spark of hope when you see that some of your sales reps have been leaving notes detailing why they’ve lost certain deals, but those hopes are dashed when you realize the data is biased, incomplete, or lacking sufficient detail.

CRM reports can show you what happened on past deals from your reps’ perspectives, but they come up short in explaining why.

Clozd recently compared CRM data from 1,000 deals to the actual reasons buyers said those deals were lost. (Check out the full results here.) We discovered that 85% of the time, closed-lost data from the CRM is completely wrong. That means there’s a big gap between what your sales reps think happened and what buyers actually experienced.

Using CRM data to understand why you win and lose deals is like trying to find buried treasure using a roughly sketched, hand-drawn map. It might work better than your intuition, but it’s probably still not enough information to get you the treasure you seek.

Unsurprisingly, you need more information than a single reason selected from a drop-down menu in Salesforce to truly understand the nuances of your buyers' motivations.

Phase 3: One-off research project

After examining CRM data for trends and talking to some sales reps, you’ll eventually decide to dedicate internal resources toward understanding how and why your customers make their buying decisions.

You assign someone from product marketing, competitive intelligence, or sales enablement to start conducting buyer interviews with the goal of finding answers to a specific problem, such as:

- Why are we losing to X competitor?

- What missing feature causes us to lose the most deals?

- Why has our win rate dropped so much in the last quarter?

- Why are so many of our customers choosing not to renew?

You’ll quickly discover that win-loss interviews produce eye-opening and transformative insights.

You’ll get detailed, first-hand accounts that validate some of your assumptions. And you’ll get feedback around glaring and unexpected blind spots that are preventing you from winning more business.

But anyone who has run a win-loss program knows that the most valuable data is often the most difficult to uncover.

It’s hard to get buyers to agree to (and show up for) an interview, especially for lost deals.

“With Clozd, we’re able to dive into the reasons we lose deals. Often in VOC/win-loss programs, it's hard to get feedback on losses, as lost prospects often don’t want to talk to the company. But with Clozd, we can get that feedback and focus on closed-won and renewal interviews ourselves.”

Adam Stewart | Director of Product Marketing at Quantum Metric

And once you’re actually able to do an interview, it’s a challenge to aggregate the data, find actionable insights, and distribute those insights within the organization in a way that leads to actual improvements.

But if you can do your win-loss analysis project, and do it well, you start to realize it’s like being handed a detailed map that can take you straight to the Holy Grail.

Yet companies often stop their win-loss efforts after conducting only a handful of interviews. Once they get a bit of feedback about their pricing, product, or sales process, they make some improvements and then decide that their research project is done.

It’s difficult to maintain an ongoing win-loss program when your only buyer intelligence tools are a spreadsheet, some Zoom recordings, a 200-page Google Doc full of transcripts, a PowerPoint deck, and an employee who performs this work part time.

"The team at Clozd has made my life easier by handling interviews on our behalf. Our Product Marketing team struggles to find time for this task. In addition, Clozd’s ability to quickly show us trends on why we succeed or fail is incredibly valuable. This provides us with clear direction on what actions we need to take to increase our business success."

James Erickson | Market Intelligence Manager at AppFolio

Eventually, your program will meet one of three inevitable fates:

- It will fall by the wayside due to a lack of resources or burnout from the internal champion.

- It will limp along without providing much value due to lack of responses from customers, insufficient or untrustworthy data, or an inability to get buy-in from necessary stakeholders.

- Key leaders will realize that a win-loss program might be more successful if it were a systemic program run by third-party experts who have developed purpose-built technology to do this sort of work.

Phase 4: Ongoing research with limited scope

At this point, savvy leaders like you will realize how helpful win-loss data is and move toward creating a continuous loop of win-loss feedback. We recommend starting off with a narrow scope by studying a small subset of your pipeline.

Using your CRM data to tell you what and where you’re losing can help narrow your focus even further. As you pursue buyer feedback in a problem area, you can start to make improvements and then shift your win-loss program as needed to either dive deeper into that problem or re-focus it on other issues within your business.

An ongoing program with a narrower scope can provide incredibly valuable insights that help you win more—but you still won’t be getting the full picture.

A good example of this is when companies only focus their win-loss programs on losses, which can give you a clear picture of what you’re doing wrong but leaves out the vital perspective of what you’re doing right. Comprehensive programs that evaluate both wins and losses often yield better results because they help leaders understand and double-down on their strengths while also identifying ways to fix their weaknesses.

Phase 5: Ongoing program with full pipeline coverage

The relationship with a third-party win-loss analysis vendor often starts small—usually on a limited basis for only a portion of your business.

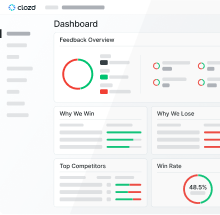

As the program yields results—and as you see how easy it is to generate reports, filter data, and uncover insights you never would have gotten by conducting the interviews on your own—you’ll start thinking about other ways to leverage win-loss methodologies with other teams and business segments.

Your sales team can leverage these interviews to

A recent Clozd study on the ROI of win-loss analysis revealed that our clients use buyer feedback collected from their win-loss interviews to make strategic changes throughout their business and drive more revenue. Here are five of the most impactful ways they’re leveraging this data:

- 71% made changes to the sales experience

- 40% made changes to product offering

- 42% made changes to pricing & packaging

- 44% made changes to marketing strategy

- 32% made changes to customer journey & churn reduction

Additionally, we’ve seen that 100% of companies that spend $100,000 or more per year on win-loss analysis plan to maintain or increase their level of investment.

Why?

It’s simple. Once you’ve drunk from the Holy Grail, you can’t go back.

There’s a direct and overwhelmingly positive ROI attached to win-loss analysis. Once your organization experiences the value of a comprehensive win-loss program, it’s impossible to revert back to the way things were when you were blindly aiming at a target but still hoping to hit the bullseye.

So, where does your company currently fall on the win-loss maturity curve?

What can you do to accelerate your results?

And how can we help you hit your goals faster?

For a personalized Clozd demo, sign up here.

.svg)

.png)

.png)

.svg)

.svg)